The global ubiquity of Bluetooth® technology is unchallenged. Especially in traditional markets like audio, automotive, and phones, tablets, and PCs. Around the world, Bluetooth has grown from a preferred feature to a requisite technology, and all reports indicate that this trend is expected to only solidify over the next five years.

According to the 2019 Bluetooth Market Update, which is supported by forecasts from ABI Research and insights from several other analyst firms, trends in traditional Bluetooth markets are on the rise and show no sign of slowing down.

Audio & Entertainment

Bluetooth® technology is synonymous with wireless audio and has forever changed the way we consume media. Stripping away the hassle of cords on headsets, speakers, and entertainment devices, Bluetooth solutions enable consumers to experience music and entertainment free from wires. According to the 2019 Bluetooth Market Update, 50% of all headphones sold today include Bluetooth technology, illustrating that consumer demand for Bluetooth headsets continues to grow.

With more than 720 million shipping per year by 2023, Bluetooth headsets and headphones remain the most popular device category for audio and entertainment. But it’s not just Bluetooth headsets that are dominating the market. Rapid growth in wireless portable speakers and soundbars confirms consumer preference for and confidence in wireless audio. With nearly 90% of all speakers are forecasted to include Bluetooth technology by 2023, the market transition to wireless speakers is nearly complete.

Phones, Tablets & PCs

Now included in all new smartphones, tablets, and laptops, Bluetooth® technology has become the standard for personal wireless connections. With Bluetooth included in 100% of new smartphones, tablets, and PCs, developers can be assured the technology will be available for their applications and solutions. As a byproduct of this complete integration, smartphones are now driving the rapid adoption of location services.

Smartphones have become the go-to tool for location services, including indoor navigation, item finding, and point of interest information solutions. With more than 474 million handsets actively engaged, Bluetooth location services are now an integral part of the smartphone experience.

Automotive

A mainstay in the automotive market, Bluetooth® technology has created connections between car and driver that have brought new levels of safety to our roads while enhancing the in-car experience. Now, Bluetooth technology comes standard in nearly all new cars, and, in five years, 93% of all in-car infotainment systems worldwide will include Bluetooth capabilities as part of the in-car experience.

According to insights outlined in the 2019 Bluetooth Market Update, Bluetooth technology gained traction over the years with factory and after-market solutions and is reaching a tipping point in global market penetration. Automotive manufacturers are increasingly looking towards the smartphone to replace the key. And while in-car infotainment will continue to account for the majority of Bluetooth automotive shipments, other use cases like key fobs, sensors, and other in-car applications will grow to account for 24% of all shipments by 2023.

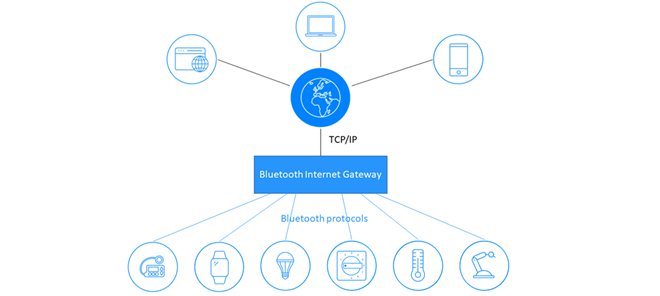

Connected Device

From household appliances and fitness trackers to health sensors and medical innovations, Bluetooth® technology connects billions of everyday devices and enables the invention of countless more. As the demand for smartwatches and hearables with health sensors grows, these multifunction devices will continue to take share from single-purpose devices over the next five years. Nearing a 3x increase in annual shipments by 2023, hearables will see a 19% CAGR (compound annual growth rate) from 2018-2023 while smartwatches will see a 22% CAGR from 2018-2023.

According to the 2019 Bluetooth Market Update, tags and trackers are also gaining significant momentum as location services like item finding and pet tracking become more pervasive in everyday life. Item finding tags will near 10% of total volume in connected devices by 2023 with a 32% CAGR over the next five years.

Meeting Market Needs

Despite the fact that the Bluetooth® community continues to meet the needs of emerging commercial and industrial markets, Bluetooth technology is still the major player in traditional consumer devices. It’s in these markets that the community has secured global brand recognition, transforming Bluetooth capabilities into an expected feature in new consumer devices. All forecasts indicate that Bluetooth technology will continue to meet traditional market demands for years to come.

For more trends and forecasts in traditional Bluetooth markets, and new data and insights in emerging smart markets, such as smart home, smart building, smart industry, and smart city, download the 2019 Bluetooth Market Update.

![]()

FEATURED REPORT

The Bluetooth® Market Update

See the most important trends and forecasts for Bluetooth® technology, and learn how the Bluetooth community continues to solve new connectivity challenges and address new market opportunities.

![20240208 GN LONDON 04 LARA 0964 Edit copy[1]](https://www.bluetooth.com/wp-content/uploads/2024/04/20240208_GN_LONDON_04_LARA_0964-Edit-copy1.jpg)

![Forbes Predictions article 72 dpi 1300 x 680 px 768x402[1]](https://www.bluetooth.com/wp-content/uploads/2024/04/Forbes-Predictions-article-72-dpi-1300-x-680-px-768x4021-1-660x345.png)

![ABI Growth Chart.png 815076338[1]](https://www.bluetooth.com/wp-content/uploads/2024/03/ABI_Growth_Chart.png_8150763381-660x384.png)

![2312 CES Handout Images FINAL existing pdf 464x600[1]](https://www.bluetooth.com/wp-content/uploads/2024/01/2312_CES_Handout-Images_FINAL-existing-pdf-464x6001-1.jpg)

![2312 CES Handout Images FINAL unlimited pdf 464x600[1]](https://www.bluetooth.com/wp-content/uploads/2024/01/2312_CES_Handout-Images_FINAL-unlimited-pdf-464x6001-1.jpg)