2022 Bluetooth® Market Update

A Letter from the CEO

Every year, the Bluetooth SIG member community works hard to deliver innovations that improve the capabilities of Bluetooth® technology and help shape new market trends. From wireless audio and wearable devices to asset tracking and network lighting control solutions, Bluetooth SIG member companies continue to meet the needs of consumer, commercial, and industrial use cases.

Thanks to the hard work of everyone involved, the LE Audio specification project is nearing completion. It is, perhaps, the most complex specification project the Bluetooth SIG has ever taken on, involving hundreds of people across multiple working groups and committees. We look forward to completing the project this year and ushering in the next 20 years of audio innovation.

The upcoming adoption of LE Audio will be the most recent in a long line of Bluetooth enhancements that have made a significant impact on wireless markets. We are excited to share the latest market insights and trends in this year's Bluetooth Market Update. The forecasts in the 2022 Bluetooth Market Update reflect the tireless work of the many Bluetooth SIG members who are developing innovations that create a more connected world.

It's an honor to be part of such an incredible community.

Mark Powell | CEO | Bluetooth SIG, Inc.

Supported by updated forecasts from ABI Research and insights from several other analyst firms, the Bluetooth Market Update is intended to help global Internet of Things (IoT) decision makers stay up to date on the role Bluetooth technology can play in their technical roadmaps and markets.

Supported by updated forecasts from ABI Research and insights from several other analyst firms, the Bluetooth Market Update is intended to help global Internet of Things (IoT) decision makers stay up to date on the role Bluetooth technology can play in their technical roadmaps and markets.

Unless otherwise noted, stats without a specified source are from ABI Research. Data files referenced from ABI Research include Bluetooth Data Set (4Q21), Wireless Connectivity (4Q21), Mobile Accessories and Wearables (4Q21), Indoor Positioning and RTLS (4Q20), Connected Car (3Q21), Smart Home Systems (2Q21), Smart Home Hardware (1Q22), Internet of Everything (1Q22). Forecasts do not constitute a promise to ship.

Bluetooth®

Total Shipments

Annual Device Shipments

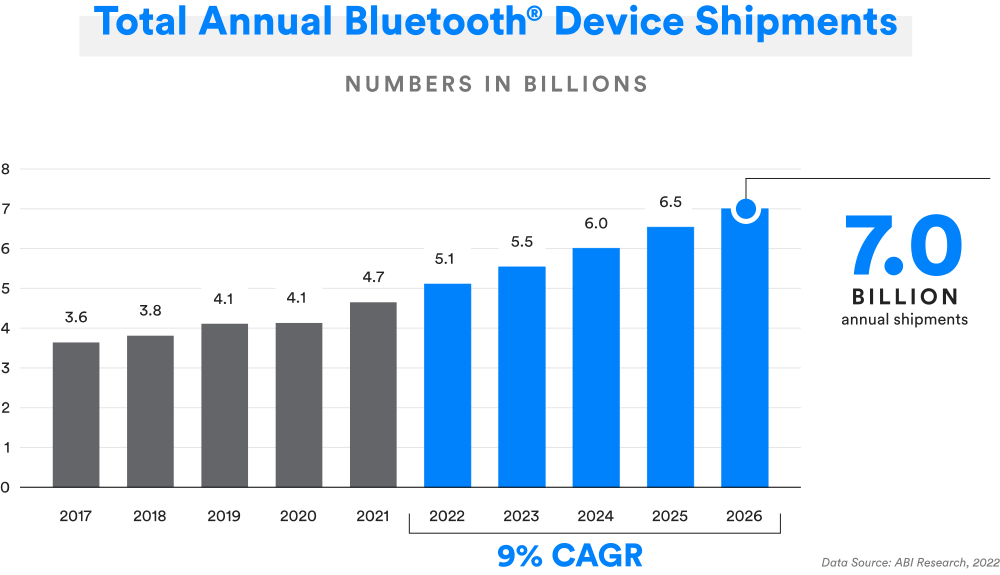

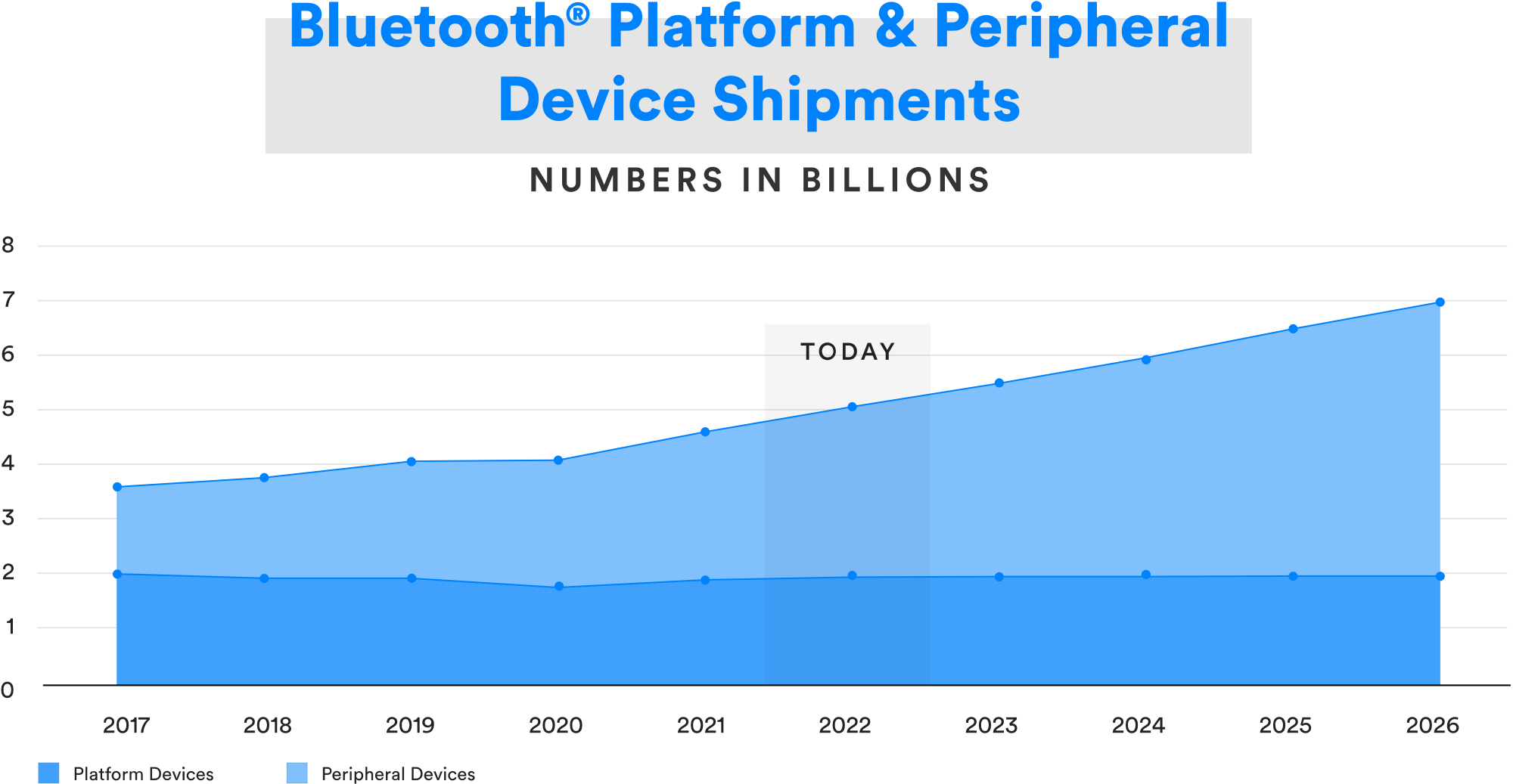

For the first time, Bluetooth® annual device shipments are on track to exceed 7 billion in 2026

With the support of a committed member community, Bluetooth® technology has met growing wireless innovation demands for more than 20 years. While 2020 proved to be a turbulent year for many global markets, by 2021, Bluetooth markets began quickly bouncing back toward pre-pandemic levels. In fact, in 2022, analysts expect to see a faster recovery from the pandemic than initially predicted. Analysts anticipate that annual shipments of Bluetooth enabled devices will see 1.5x growth, a 9 percent compound annual growth rate (CAGR), from 2021 to 2026.

Total Shipments

Shipments by Radio

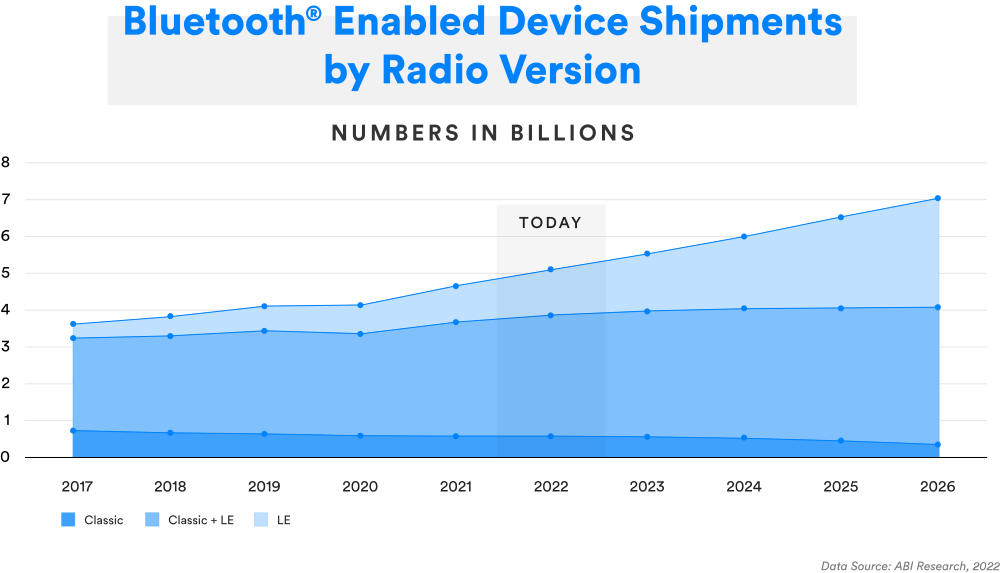

Bluetooth® technology supports multiple radio options, allowing developers to build products that meet the unique connectivity needs of their customers.

Today, Bluetooth Classic and Bluetooth Low Energy (LE) radios are included in all key platform devices, from smartphones to tablets to laptops. Because of this, most Bluetooth devices shipped over the last five years have been dual-mode (Bluetooth® Classic + Bluetooth LE) devices. Furthermore, many audio devices, such as earbuds, are also shifting to dual-mode operation.

Due to the continued strong growth of connected consumer electronics devices, combined with the upcoming release of LE Audio, annual shipments of single-mode Bluetooth® LE devices will almost match those of dual-mode annual device shipments over the next five years.

3x GROWTH

in Bluetooth® LE single-mode devices between 2022 and 2026

Peripherals drive single-mode Bluetooth LE device growth

Bluetooth® LE single-mode device shipments are forecasted to more than triple over the next five years, driven by continued strong growth in peripheral devices. In addition, when you consider both single-mode LE and dual-mode Classic + LE devices, 95 percent of all Bluetooth devices will include Bluetooth LE by 2026, a 25 percent CAGR.

100%

of key new platform devices support dual mode (Bluetooth® Classic + Bluetooth LE)

All platform devices support Bluetooth Classic and Bluetooth LE

Developers can count on Bluetooth® Classic and Bluetooth LE to be in all platform devices. With Bluetooth LE and Bluetooth Classic in 100 percent of phones, tablets, and PCs, the number of dual-mode devices supported by Bluetooth technology is reaching complete market saturation with a one percent CAGR from 2021 to 2026.

72%

of Bluetooth® enabled device shipments in 2026 will be peripheral devices

Peripherals will continue to drive the growth of Bluetooth® device shipments

Since nearly all smartphones, tablets, and PCs support Bluetooth® LE, the growth rate of Bluetooth technology in peripheral devices will continue to outpace platform device growth. Analysts forecast a 13 percent CAGR from 2021 to 2026.

Total Shipments

Future Enhancements

The Bluetooth SIG member community continues to expand the capabilities of Bluetooth® technology — powering innovation, creating new markets, and redefining what’s possible in wireless communication. The hard work and collaboration between our member companies are what drives continuous innovation. Typically, there are more than 50 active specification projects in process, and here is some of the work underway for Bluetooth technology.

LE Audio

Building on 20 years of innovation, LE Audio will enhance the performance of Bluetooth® audio, add support for hearing aids, and enable Broadcast Audio, an innovative new Bluetooth feature with the potential to once again change the way we experience audio and connect with the world around us.

High-Accuracy Distance Measurement

Adding to the growing set of device positioning capabilities of Bluetooth® wireless technology – which currently includes presence (via advertisements), distance (via RSSI), and direction finding (via AoA/AoD) – a specification development project is currently underway to enable high-accuracy distance measurement between two Bluetooth enabled devices. This feature is expected to enhance the performance of locating systems and digital key solutions.

Higher Data Throughput

Today, an increasing number of use cases and applications are looking for even greater data transfer performance, as well as support for streaming larger media, and could benefit from a higher data rate Bluetooth® LE PHY. Work is currently underway to address this growing market opportunity.

Bluetooth®

Solution Areas

Solutions to Meet Market Needs

Bluetooth® technology provides full-stack, fit-for-purpose solutions to meet the ever-expanding needs for wireless connectivity. After first addressing audio streaming, Bluetooth technology has expanded into low-power data transfer, indoor location services, and reliable, large-scale device networks.

Audio Streaming

The audio cable was one of the first cords Bluetooth® technology cut. Stripping away the hassle of wires on headphones, speakers, and more, Bluetooth technology revolutionized audio and has forever changed the way we consume media and experience the world.

Key Use Cases

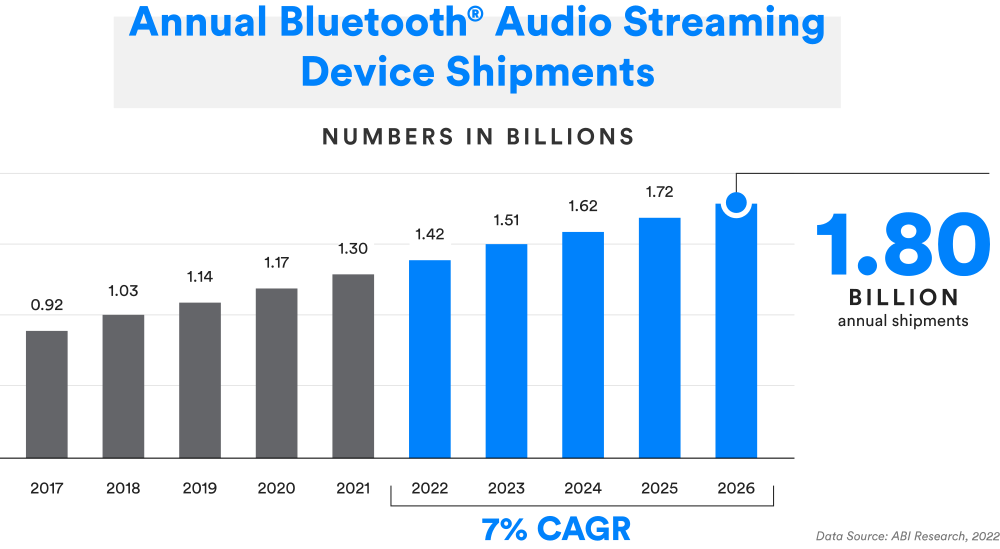

1.4 BILLION

1.4 BILLION

Bluetooth® Audio Streaming devices will ship in 2022

1.4x GROWTH

in annual Bluetooth® Audio Streaming device shipments from 2022 to 2026

Audio Streaming

Drivers for Today

Bluetooth® technology is now in nearly all wireless speakers

As overall demand and the desire for more flexibility and mobility increases, the adoption of Bluetooth technology in speakers will also continue to expand. 374 million Bluetooth® speakers are expected to ship this year with 425 million forecasted annually by 2026.

Earbuds are the leading driver of growth for headphones

This year, 263 million Bluetooth® earbuds will ship, accounting for 39 percent of all wireless headsets. By 2026, annual Bluetooth earbud shipments will triple, climbing to 619 million and making up 66 percent of all wireless headsets.

374 MILLION

374 MILLION

Bluetooth® speakers will ship in 2022

675 MILLION

675 MILLION

Bluetooth® headphones will ship in 2022

Audio Streaming

Drivers for Tomorrow

Building on 20 years of innovation, LE Audio will enhance the performance of Bluetooth® audio, add support for hearing aids, and introduce exciting new features that will enable the creation of new products and use cases.

LE Audio will also add Broadcast Audio, a new capability that will enable an audio source device (e.g. a smartphone) to broadcast one or more audio streams to an unlimited number of audio sink devices (e.g. earbuds, speakers, hearing aids). Broadcast Audio opens significant new opportunities for innovation, including the enablement of personal and location-based audio sharing.

LE Audio will deliver enhanced audio performance

LE Audio provides higher audio quality at lower power, enabling audio developers to meet increasing consumer performance demands and drive continuous growth across the audio peripheral market (headset, earbuds, etc.). By 2026, annual Bluetooth® earbud shipments will climb to 619 million, making up 66 percent of all wireless headsets.

3x GROWTH

in annual Bluetooth® earbud shipments by 2026

66%

of all annual Bluetooth® headset shipments will be earbuds by 2026

LE Audio will deliver new audio peripherals

The lower power capabilities of LE Audio will enable new types of audio peripherals — such as a wider range of Bluetooth® enabled hearing aids — and allow greater flexibility for better form factors. With LE Audio, smaller, less intrusive, more comfortable hearing devices will emerge, enhancing the lives of those with hearing loss.

½ BILLION

½ BILLION

people need audio accessibility today

2.6x GROWTH

in annual Bluetooth® hearable shipments by 2026

2.5 BILLION

2.5 BILLION

people are projected to have some degree of hearing loss by 2050

LE Audio will deliver new audio experiences through broadcast audio

A new broadcast audio feature will deliver unique audio experiences for consumers that will enhance the way we engage with each other and the world around us, allowing people to listen together, hear better, and unmute the world. With the introduction of broadcast audio, Bluetooth® technology will be installed in public locations, and people will interact with audio in various public venues and environments like never before. Over 60 million locations have the long-term potential to benefit from deploying Bluetooth broadcast audio.

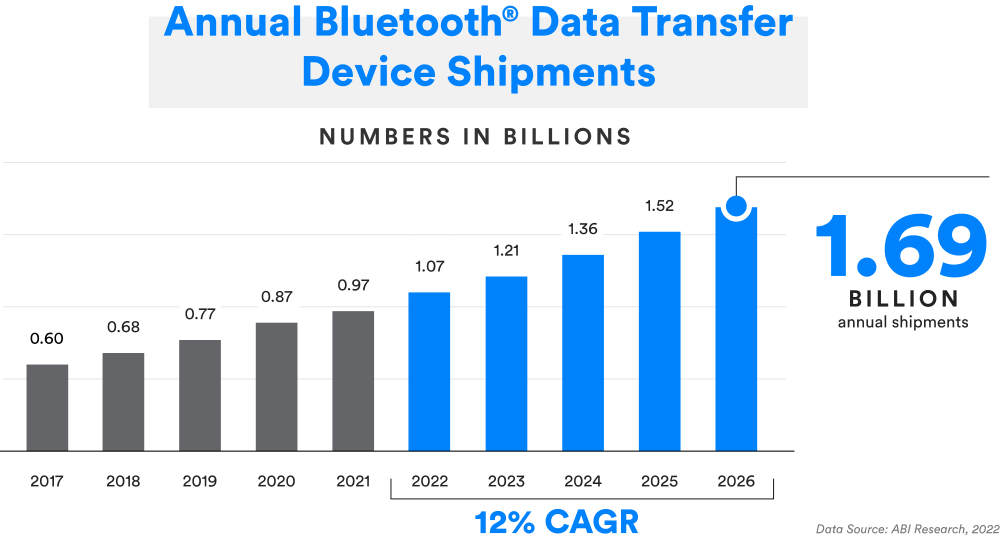

Data Transfer

From fitness trackers and health and wellness monitors to toys and tools, billions of new Bluetooth® low-power, data transfer devices free consumers from wires every day.

Key Use Cases

1.75x GROWTH

in annual Bluetooth® Data Transfer device shipments by 2026

35%

of all IoT connected devices rely on Bluetooth® technology

Data Transfer

Drivers for Today

432 MILLION

432 MILLION

personal Bluetooth® consumer electronics will ship in 2022

Personal IoT devices satisfy demands for lifestyle data

There is a growing demand for lifestyle data as more people want greater awareness regarding their health, fitness, and personal activity – including movement and habits. This increased focus on data, combined with the desire for greater convenience, has led to a rise in Bluetooth® enabled connected consumer electronics shipments – from wearables and smartwatches to tools, toys, and toothbrushes to health and fitness devices. Analysts predict annual personal consumer electronics shipments will double by 2026.

263 MILLION

263 MILLION

Bluetooth® remote controls will ship in 2022

Consumer demand for home entertainment devices surge

More people looking for greater convenience has led to an increased demand for remote controls for products such as TVs, fans, speakers, game consoles, etc. Annual Bluetooth® remote control shipments are forecasted to reach 359 million in 2026.

182 MILLION

182 MILLION

Bluetooth® PC accessories will ship in 2022

The shift to working from home is driving an increased demand for Bluetooth® PC peripherals

With more people using their home as a combined personal and professional space, there is an increasing demand for Bluetooth® connected home and peripheral devices. Bluetooth PC accessories continue to be in high demand. Analysts expect to see a 7 percent CAGR from 2022 to 2026, leading to an increase to 234 million annual PC accessory shipments in 2026.

Data Transfer

Drivers for Tomorrow

Bluetooth® wearables drive the future of data transfer device growth

A greater understanding of the personal health benefits provided by Bluetooth fitness tracking and health monitoring devices is increasing the demand for wearables from people of all ages. As such, 29 percent of annual Bluetooth Data Transfer device shipments will be wearables in 2026.

491 MILLION

491 MILLION

Bluetooth® wearables will ship annually by 2026

100 MILLION

100 MILLION

Bluetooth® fitness and wellness trackers will ship annually by 2026

Bluetooth® health and wellness wearables experience strong growth

Bluetooth® fitness and wellness trackers will see 1.2x growth in the next five years, increasing from 87 million this year to 100 million annual shipments in 2026. Fitness trackers continue to grow despite the fact that a significant number of smartwatches are taking on this functionality.

210 MILLION

210 MILLION

annual Bluetooth® smartwatch shipments by 2026

Smartwatches continue to lead the wearables category

As smartwatches become more sophisticated, adopting more features and greater functionality, they are not only taking over the role of keeping people connected (e.g., phone, email, text, music, etc.), but also taking over the role of fitness and wellness trackers. Strong volume across both categories continues with growth shifting to smartwatches. This year, 101 million Bluetooth® smartwatches will ship with that number seeing a 2.5x increase to 210 million annual shipments by 2026.

Bluetooth® AR/VR devices are set for significant growth

51% CAGR

in Bluetooth® VR headsets from 2022 through 2026

The definition of a wearable continues to expand. Wearables come in many different forms and functions to help deliver and augment other experiences; these include VR headsets for gaming and virtual training, as well as wearable scanners and cameras for industrial manufacturing, warehousing, and asset tracking. 44 million Bluetooth® VR headsets will ship annually by 2026.

68% CAGR

in Bluetooth® smart glasses from 2022 through 2026

Smart glasses are being used for navigation, superimposing directional pathways (and other supplemental information) for users to follow. Smart glasses are also being used for train-the-trainer purposes, recording tasks or processes to help educate and provide virtual confirmation of completed tasks. One of the fastest-growing categories, smart glasses will see 27 million annual device shipments by 2026.

Location Services

Bluetooth® technology is now widely used as a device positioning technology to address the increasing demand for high-accuracy indoor location services. By enabling one Bluetooth device to determine the presence, distance, and direction of another device, Bluetooth technology delivers flexibility unlike any other positioning radio, allowing building managers and owners to scale indoor positioning solutions to match the varying and changing needs of the building.

Key Use Cases

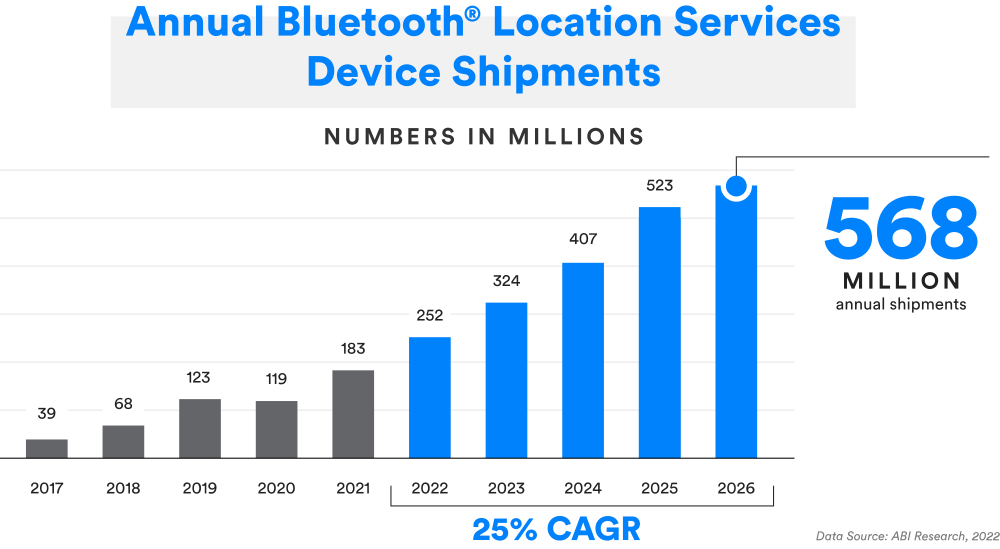

Bluetooth® Location Services device growth will trend upward over the next five years

Bluetooth® Location Services solutions are positioned for faster recovery towards pre-pandemic forecasts. Heightened awareness of the benefits of Bluetooth Location Services continues to support increased market growth.

25% CAGR

in Bluetooth® Location Services devices from 2022 through 2026

Location Services

Drivers for Today

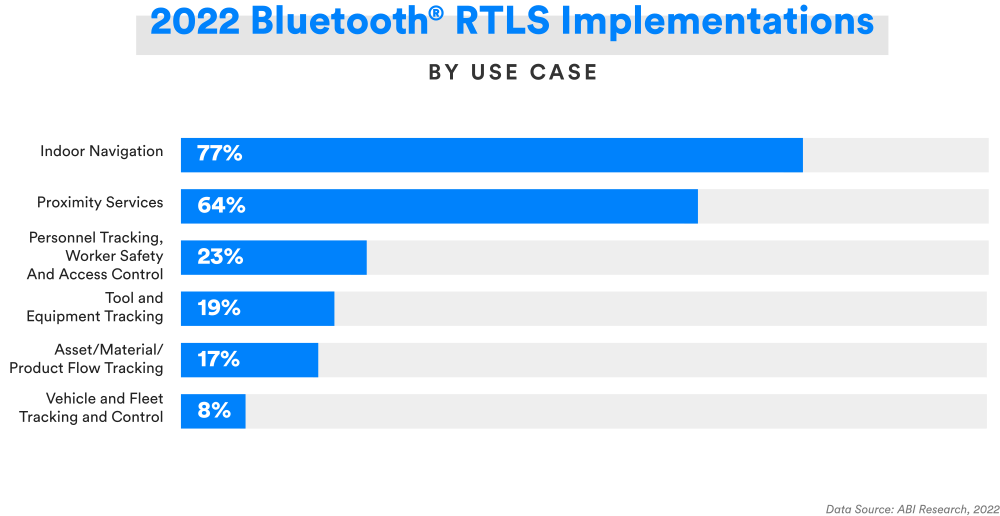

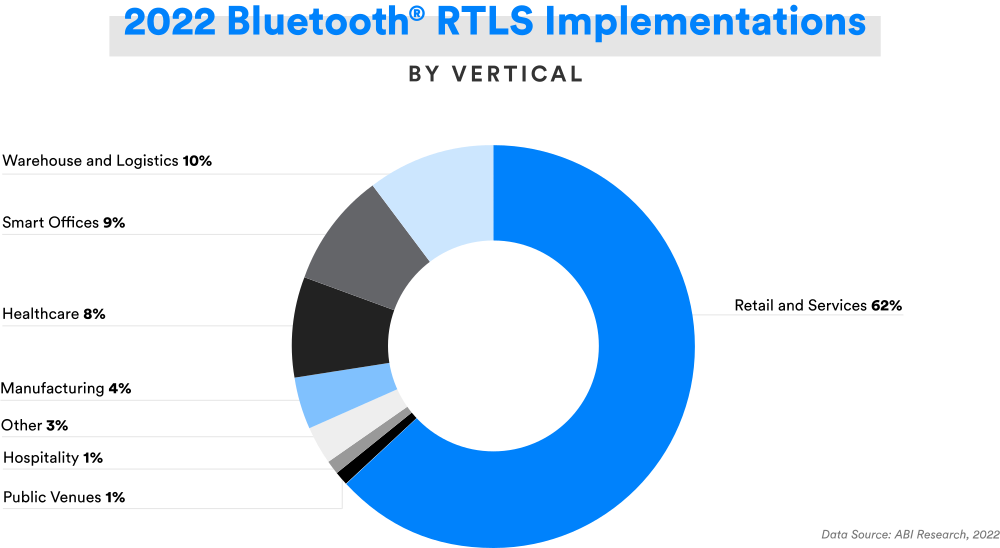

Commercial Real-Time Locating Systems

Bluetooth® Location Services take center stage as asset tracking efficiencies become key to solving supply chain challenges

Recent inventory and logistic challenges are driving the need for efficient transportation and warehousing solutions. More commercial and industrial facilities are turning to Bluetooth® asset management solutions to optimize resource and inventory control. Analysts conclude that, among Bluetooth Location Services solutions, asset tracking (RTLS) and tags are the major drivers behind continued growth. Commercial RTLS systems, including healthcare, account for the largest volume of device shipments this year.

128 MILLION

128 MILLION

Bluetooth® asset tracking devices will ship in 2022

Hospitals and healthcare facilities use Bluetooth® Location Services solutions to optimize processes

Based on a study, 58 percent of medical equipment in hospitals can go unutilized with ten percent of equipment expiring on hospital shelves. Bluetooth® technology can help optimize equipment tracking and inventory control, improving operational efficiencies and minimizing waste. In a recent case study, Riverside Healthcare shared how they used a Bluetooth asset tracking system to help quickly locate essential equipment, saving staff up to 40 hours a week.

40 HOURS

40 HOURS

a week is spent by healthcare staff looking for medical equipment

25 THOUSAND

25 THOUSAND

Bluetooth® Location Services implementations in healthcare in 2022

Consumer Item Finding Solutions

Higher accuracy is driving wider use of Bluetooth® item finding solutions

Personal item finding solutions are a major contributor to the growth of Bluetooth® Location Services device shipments. The introduction of the Samsung Galaxy SmartTag and Apple AirTags this past year is further boosting widespread acceptance of personal item finding innovations.

“By 2026, ABI Research forecasts there will be more than 140 million annual shipments of Bluetooth personal tracking devices, accelerated by new experiences, new form factors, improved accuracy, and the proliferation of tracking networks services from leading tag and mobile vendors. At the same time, the arrival of high-accuracy distance measurement in the future will enable Bluetooth to better service growing secure access applications for passive keyless entry and smart home access control applications”

ABI Research, 2022

Automotive Access Control

Bluetooth® technology is playing an important role in automotive access control

Increasing recognition and acceptance of digital keys are driving demand for more access and control capabilities in smartphones. Bluetooth® based fobs not only allow locking and unlocking doors but also bring more convenience to drivers.

24 MILLION

24 MILLION

Bluetooth® key fobs and accessories will ship in 2022

Leading automotive vendors now support smartphone digital key capabilities

Building on the success of the key fob, Bluetooth® technology in the smartphone can help securely access automobiles while limiting the number of devices that need to be carried. Having achieved 100 percent penetration in smartphones, Bluetooth technology is uniquely positioned to meet this demand.

Location Services

Drivers for Tomorrow

The Bluetooth® technology roadmap is driving the development of new, higher-performing solutions

RSSI, direction finding, and, soon, high-accuracy distance measurement capabilities position Bluetooth® technology to support a wide range of powerful, flexible solutions. From improved accuracy to precise positioning at a lower cost, Bluetooth technology provides developers with the reliability and flexibility they need to create location services solutions that are even more powerful with greater accuracy.

3x GROWTH

in annual shipments of Bluetooth® Location Services devices over the next five years

High-accuracy distance measurement will improve the performance of item finding and digital key solutions

By adding high-accuracy distance measurement, item finding solutions will see increased performance, providing greater precision as users get closer to an item being located. High-accuracy distance measurement will also improve the user experience for passive keyless entry, unlocking a vehicle on approach.

140 MILLION

140 MILLION

Bluetooth® personal tracking devices will ship annually by 2026

Increased precision will accelerate the adoption of Bluetooth® asset tracking systems

By incorporating direction finding, Bluetooth® RTLS solutions can move from meter-level to centimeter-level accuracy. This will improve the performance of existing use cases as well as enable new ones requiring higher accuracy and lower latency. Measuring in centimeters and milliseconds instead of meters and seconds, Bluetooth Direction Finding is now enabling sports and entertainment venues worldwide to track fast-moving athletes, pucks, balls, and equipment during games.

350 MILLION

350 MILLION

Bluetooth® asset tracking devices will ship in 2026

4x GROWTH

in annual shipments of Bluetooth® asset tracking devices over the next five years

Device Networks

Bluetooth® Device Network solutions in home, commercial, or other environments can reliably and securely connect tens, hundreds, or thousands of devices within a network.

Key Use Cases

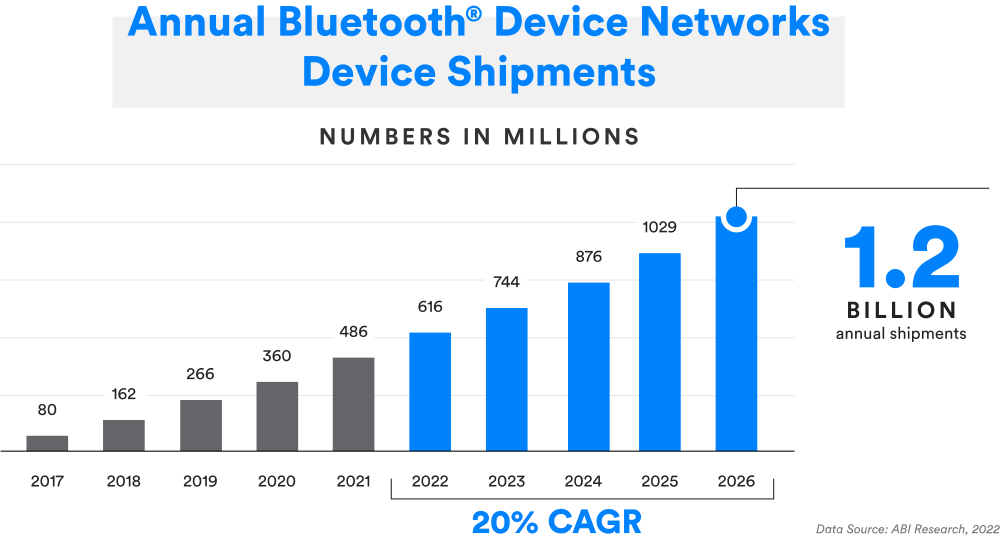

Annual device network device shipments will surpass 1 billion within the forecast period

Driven by an increase in Bluetooth® networked lighting control and home automation solution deployments, analysts expect to see a sharp rise in annual Bluetooth Device Network device shipments over the next five years, reaching over one billion annual shipments by 2026.

1.2 BILLION

1.2 BILLION

Bluetooth® Device Network devices will ship annually by 2026

2.5x GROWTH

in annual Bluetooth® Device Network device shipments from 2022 to 2026

Device Networks

Drivers for Today

Bluetooth® is one of the key technologies enabling a network of smart home devices

Bluetooth® has established itself as the go-to technology in many smart home solutions and is now expanding its role in home IoT. Analysts predict smart home automation annual device shipments will more than double by 2026, increasing to 1.1 billion in just five years. Major devices driving forecasts include smart home automation controllers, smart lighting, and smart appliances.

552 MILLION

552 MILLION

Bluetooth® smart home devices will ship in 2022

Device Networks

Drivers for Tomorrow

Smart Home

Bluetooth® technology is positioned to be in all smart home devices

Bluetooth® technology has risen to be a fundamental requirement of all smart home solutions. Independent of the underlying wireless technologies (e.g., Bluetooth, Wi-Fi, 802.15.4, Zigbee, Thread, Matter), all smart home solutions have chosen Bluetooth technology for device onboarding to the network.

1.1 BILLION

1.1 BILLION

annual Bluetooth® smart home device shipments in 2026

Networked Lighting Control

Bluetooth® networked lighting control is experiencing mainstream traction

The proliferation of LEDs, a desire for greater energy efficiency, faster deployment capabilities, and a higher quality occupant experience are driving the demand for Bluetooth® commercial networked lighting control solutions.

14.2% CAGR

in annual shipments of global lighting control systems from 2022 to 2029

Data Source: Guidehouse Insights, 2020

“The commercial building automation market is expected to be one of the fastest growing applications for Bluetooth within the IoT between 2021 and 2026, achieving a CAGR of 76% and growing to nearly 50 million annual device shipments. Bluetooth commercial lighting, switch, and controller shipments are expected to reach nearly 8 million annual shipments by 2026, many of which will help accelerate the wider adoption of other commercial building use cases such as environmental sensors, which are expected to grow 13x between 2021 and 2026, reaching over 13.5 million annual shipments at this time.”

ABI Research, 2022

Commercial ROI of Bluetooth® networked lighting control becomes more apparent

Used across offices, warehouses, retail environments, and other large commercial spaces, Bluetooth networked lighting control systems provide building managers with advanced control while helping to create additional savings and efficiencies.

The benefits of Bluetooth® networked lighting control go far beyond illumination

Customers demand greater insight into buildings. A Bluetooth® networked lighting control system provides the infrastructure needed for increased granular data and integration with other building automation systems, including environmental sensors (air quality, temperature, humidity, etc.) and HVAC, as well as enabling building managers to automate and extend the life of core systems.

70%-75%

70%-75%

reduction in energy costs achieved through connected lighting and advanced lighting controls

Data Source: Enterprise IoT Insights, 2020

26%

of networked lighting control hardware shipments in 2029 will power additional building automation use cases

Data Source: Guidehouse Insights, 2020

Join the Bluetooth Market Research Community

Receive early access to the latest Bluetooth® market trends and forecasts and weigh in on what data is collected and shared to ensure you receive the research that's most valuable to you and your business.